virginia military retirement taxes

Virginia military retirees 55 years and older will be able to keep more of their retirement income thanks to language in the state budget passed this spring by the states. Commonwealth of Virginia Constituent Services PO.

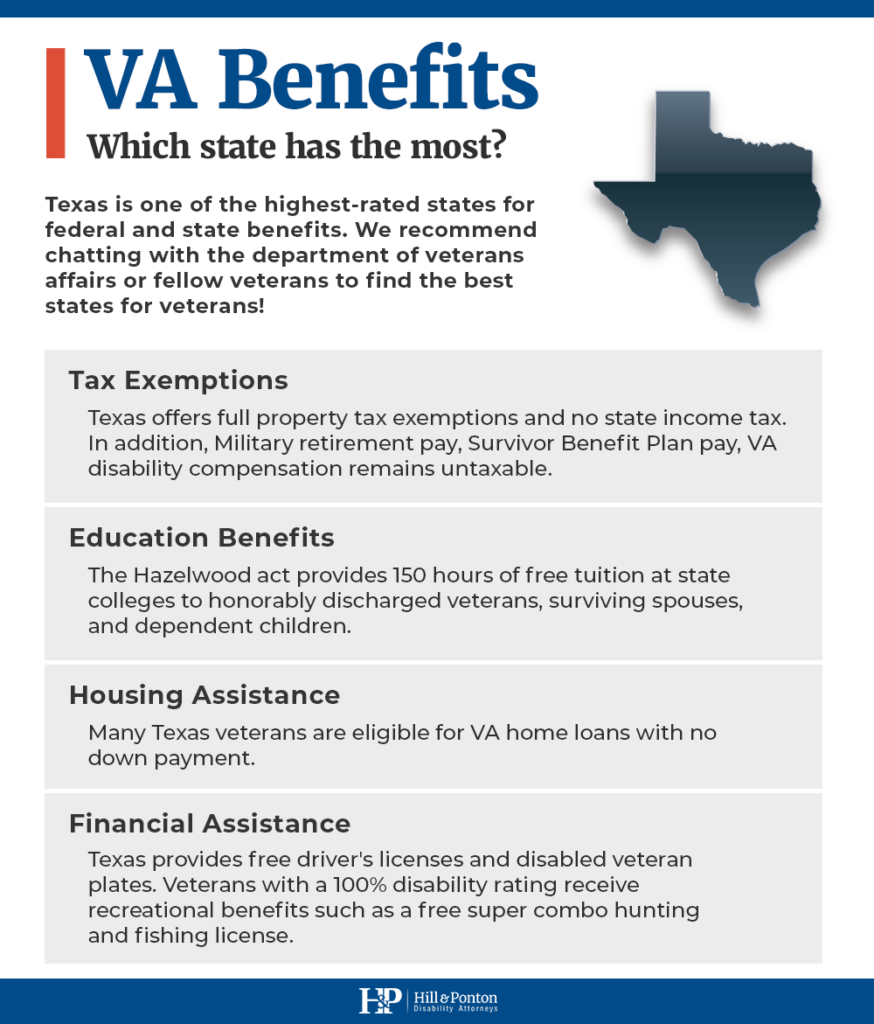

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Currently Virginia does not exempt military retirement income while three of Virginias neighbors NC WV and MD have some level of state tax exemption on military retirement income.

. Virginia has a number of exemptions and deductions that make the state tax-friendly for retirees. Those ages 55 - 64 can exclude up to 20000 and. This subtraction will increase each year by 10000.

Our message is simple. Latest on Grassroots Work to Exempt Military Retirement. For taxable years beginning on and after January 1 2022 but before January 1 2023 up to 20000 of military benefits.

Beginning with your 2022 Virginia income tax return you may be able to claim a subtraction for certain military benefits. Virginia Taxes and Your Retirement. Colorado - Military retirees ages under age 55 can exclude up to 10000 of their retirement pay from their gross income.

Withholding of Virginia Income Tax from Military Retirement Pay. Legislation to permit the withholding of state income taxes from military retirement pay has. Up to 15000 of military basic pay received during the taxable year may be exempted from Virginia income tax.

3247 into law on May 13 exempting all military. A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. For taxable years beginning on and after January 1 2 023 but.

For the 2022 tax year Veterans age 55 and over who are receiving military retired pay can deduct 10000 from their Virginia taxable income. When you come back to the. It exempts all Social Security income from the state income tax.

Beginning in 2022 veterans 55 years of age and older can deduct up to 10000 of military retirement income and other military benefits. To help make that possible we are working diligently to eliminate taxes on the first 40000 in military retirement pay. How to File and Pay Sales Tax.

Sales Tax Rate Lookup. State Tax Update. Subtraction for military retirement income.

Accelerated Sales Tax Payment. It is my belief that after serving 20 or more years as a member of the armed services and have decided to make Virginia your permanent home the state government of Virginia should not. Up to 15000 of military basic pay may be exempted from Virginia income tax.

It also provides seniors with a. The subtraction is reduced when military pay exceeds 15000 and is fully. Lets eliminate the tax on the first 40000 in military.

The deduction is increased to 20000. For every 100 of income over 15000 the maximum subtraction is reduced by. Members of the Virginia General Assembly are already hard at work balancing the books for the budget this year.

Individual Retirement Accounts IRAs With a traditional IRA you usually can deduct the amount you contributed to the account from your federal taxes. Request a Copy of a Tax Return. Military personnel stationed inside or outside Virginia may be eligible to subtract up to 15000 of military basic pay received during the taxable year provided they are on extended active duty.

Henry McMaster signed H. Box 1475 Richmond VA 23218 804-786-2211 Email the Secretariat.

State Lawmakers Have Taken Action To Help Veterans And Congress Is Seeking To Follow Suit

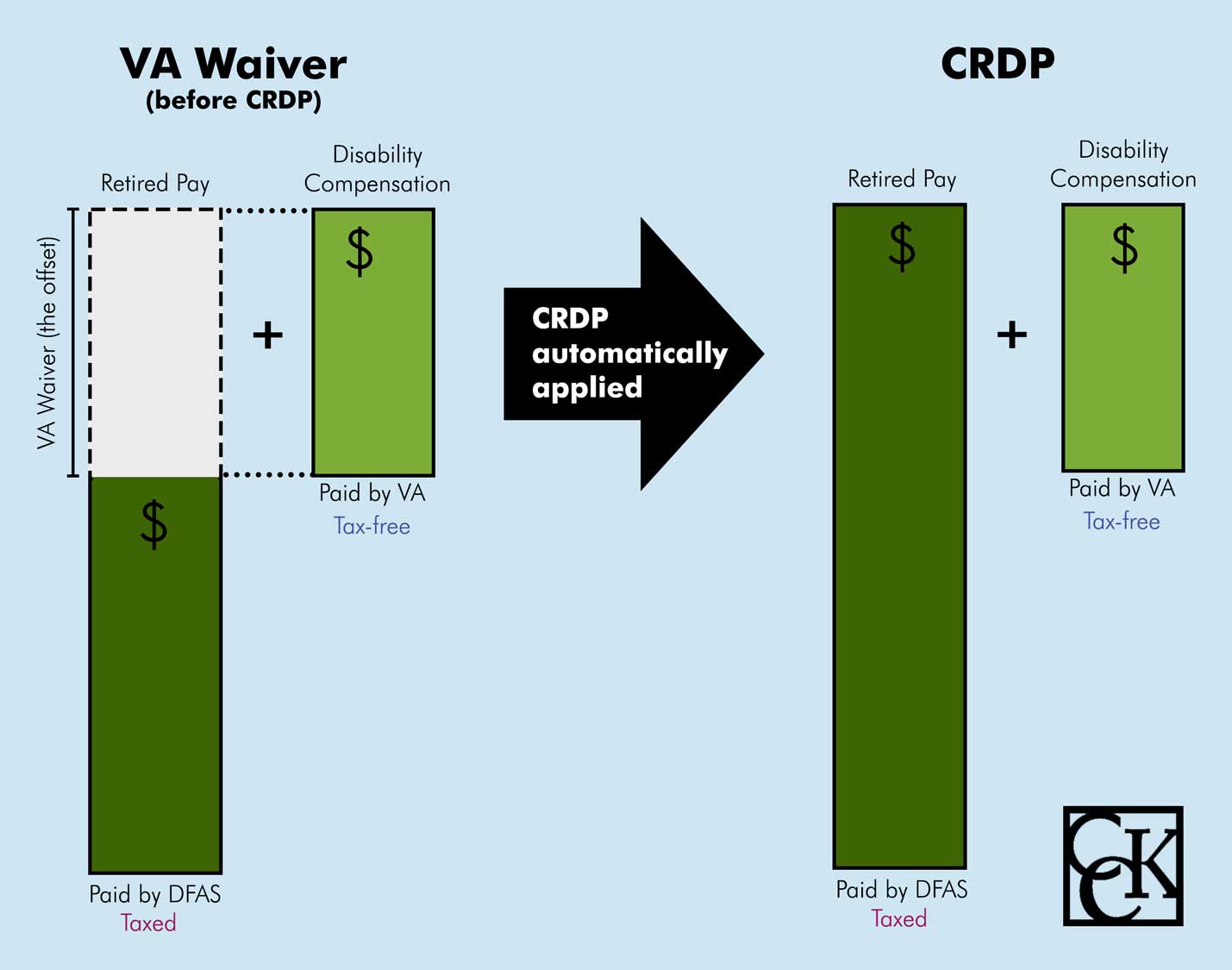

Can You Receive Va Disability And Military Retirement Pay Cck Law

Virginia Retirement Tax Friendliness Smartasset

Tax Breaks For Disabled Veterans Military Com

Virginia Military And Veterans Benefits The Official Army Benefits Website

State Tax Information For Military Members And Retirees Military Com

Virginia Military And Veterans Benefits The Official Army Benefits Website

The Most Tax Friendly States For Retirement Retirement Retirement Income Best Places To Retire

Moaa State Tax Update Latest On Grassroots Work To Exempt Military Retirement

Virginia Commonwealth Veteran Benefits Military Com

These States Don T Tax Military Retirement Pay

Virginia Retirement Tax Friendliness Smartasset

Moaa State Tax Update Details On New Virginia Retiree Exemptions And Much More

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com

Do You Have To Report Va Disability As Income For 2022 Taxes Hill Ponton P A

10 Most Tax Friendly States For Retirees Retirement Locations Retirement Tax

Virginia Taxes And Your Retirement Virginia Tax

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/6I3BBLL3ZVAX3EZM25ZRNFTA3Q.jpg)

Here S Where Troops And Military Retirees Can Go For Free Tax Help